When a company decides to create more shares (the offering), the shares created must be filed on top of an exiting Form S-3 (F-3 for foreign companies) or the Shelf Registration (the “Shelf”). The Shelf is a way of telling the SEC that it has the intention of creating more shares and raising capital at any time in the future. The SEC reviews the Shelf and approves it by submitting a Notice of Effectiveness (the “EFFECT”). Neither the Shelf or the EFFECT diluted the existing shares outstanding!

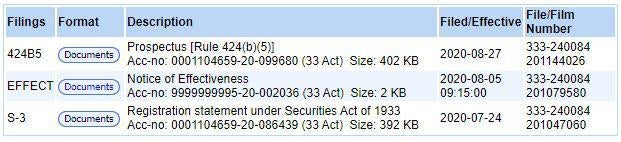

When a S-3 is filed, a file number is created to hold the EFFECT and future offerings. Here’s a S-3 file from XSPA:

In the above SEC file, you’ll see the Shelf (S-3), a Notice of Effectiveness (EFFECT) and a Prospectus (424B5). The 424B5 is the offering! The EFFECT is always filed before the first 424B5. There can be multiple 424B5, as depicted below from an older S-3 for XSPA:

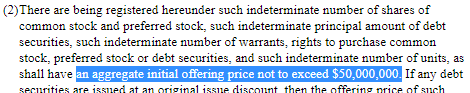

Now here’s a snippet of the S-3, where it’s stated that the aggregate initial offering price is set at $50,000,000:

This is stating that the total amount raised by all the 424B5s to be filed under the Shelf cannot exceed the $50 million declared in the S-3. When this cap is reached and the company wants to raise more capital via offerings, then they will need to file another Shelf.

The Probability of an Offering

If you’re worried about an offering dropping out of the blue for a stock you’re currently long, then go to the SEC website, search for the company by name and see if it has any S-3 filings in the past one or two years. If you see an S-3, click on Documents button to open up the filing and then click on the File No. link located in the bottom (see pic below).

This will open up the File number that includes the S-3, its EFFECT and the 424B5s (if any). If its just the S-3, then the odds of an offering is low for that S-3. If there’s an EFFECT but no 424B5, then be wary of an offering dropping in the near future.

If you see the S-3 file contain the EFFECT and one or more 424B5, then you’ll need to subtract the total amount of capital raised from the 424B5s from the aggregate amount declared in the S-3. If the total amount raised from all offerings is close to the maximum declared in the S-3 (also see S-3/A, if any), then the likelihood of another offering is slim (assuming there aren’t any other S-3s filed for that same company). If the amount raised from the offerings is a small portion of the amount declared in the S-3, then there is a good chance a big offering will come in the near future.

On a final note, if the aggregate initial offering price in the S-3 is very large (typically $200,000,000), then there is a strong possibility that the company will drop a huge offering within a year or two after the S-3 was filed.